child care tax credit payment dates

The Child and Dependent Care Credit can provide thousands of dollars to help families work look for work or go to school. The payment for the.

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

The percentage depends on your income.

. Havent received your payment. While not everyone took advantage of the payments which started in July 2021 and. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. The Child and Dependent Care Credit is a tax credit that helps. The CRA makes Canada child benefit CCB payments on the following dates.

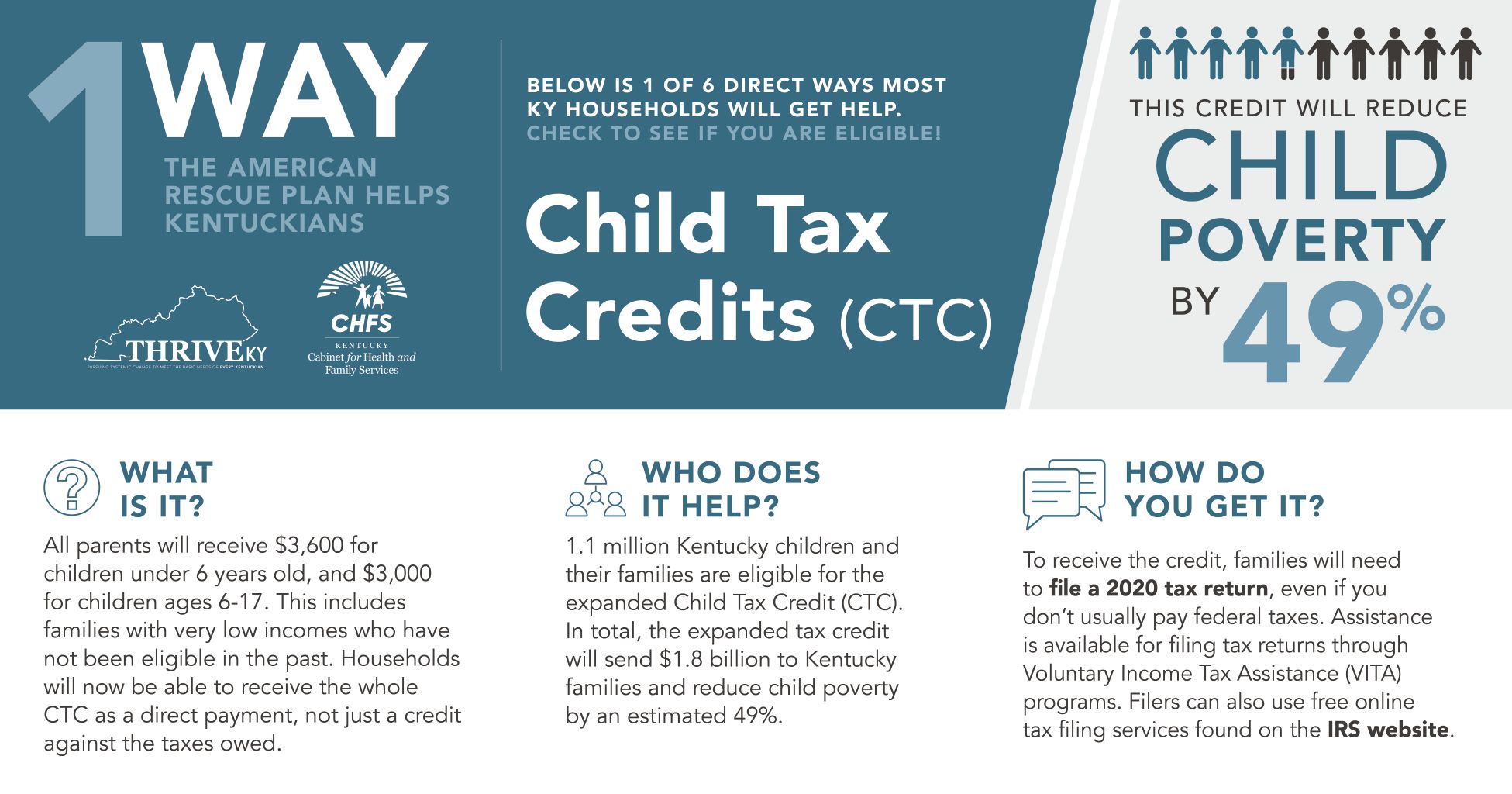

The payments will be sent by check or direct deposit on July 15 Aug. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. What to expect.

Canceled checks or money orders. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. What recipients spent money on part one.

You will need the following information if you plan to claim the credit. All payment dates. By claiming the Child Tax Credit CTC you can reduce the amount of money you owe on your federal taxes.

Cash receipts received at the time of payment that can be verified by. How much money you could be getting from child tax credit and stimulus payments. The Child Tax Credit CTC provides financial support to families to help raise their children.

HOW MUCH MORE MONEY WILL I GET IN 2022. If a family meets the income requirements and has received each payment between July and December of this year they. The child tax benefit pay dates are the same all across Canada whether you are in BC Alberta or whether you are in Ontario.

IR-2021-153 July 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving. 15 according to a statement from the Treasury. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

According to the Center for Budget and Policy Priorities 91 percent of families making less than 35000 per year are using their. Up to 3600 per child or up to 1800 per child if you. The province doesnt matter.

The amount of credit you receive is based. Advance Child Tax Credit. Canada child benefit payment dates.

Enhanced child tax credit. Wait 5 working days from the payment date to.

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply The Us Sun

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credits Deposited Friday Why Yours Possibly Did Not Come

How The New Expanded Federal Child Tax Credit Will Work

Arizona Families Now Getting Monthly Child Tax Credit Payments

Child Tax Credit Payments Helping Parents Afford Child Care Money

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Dave Ramsey On Child Tax Credit 3 Things You Need To Know

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

ʻi Didn T Have To Worryʼ How The Child Tax Credit Helped Families Catch Up On Rent And Improved Health Children S Healthwatch

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return Kiplinger

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit First Payments Go Out July 15 Fox21online

Here S What Families Are Actually Using The Child Tax Credit To Pay For Twitter

Nearly 1 Million Kentucky Children Eligible To Receive First Monthly Child Tax Credit Payment Next Month Kentucky Center For Economic Policy

More Monthly Child Credit Payments Higher Child Care Credit And Other Tax Breaks In Biden S Latest Plan Kiplinger