maine excise tax exemption

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Partially exempt property tax relates to the following categories.

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Excise Tax is defined by State Statute as a tax levied annually for the.

. 6561J Business Equipment Tax Exemption 36 MRS. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. 681 - 689 Snowgrooming equipment 36 MRS.

An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. 100-disabled Veterans are Exempt from one Vehicle Excise Tax Title Fee and Drivers License Renewal Fee. Excise tax is defined by Maine law as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

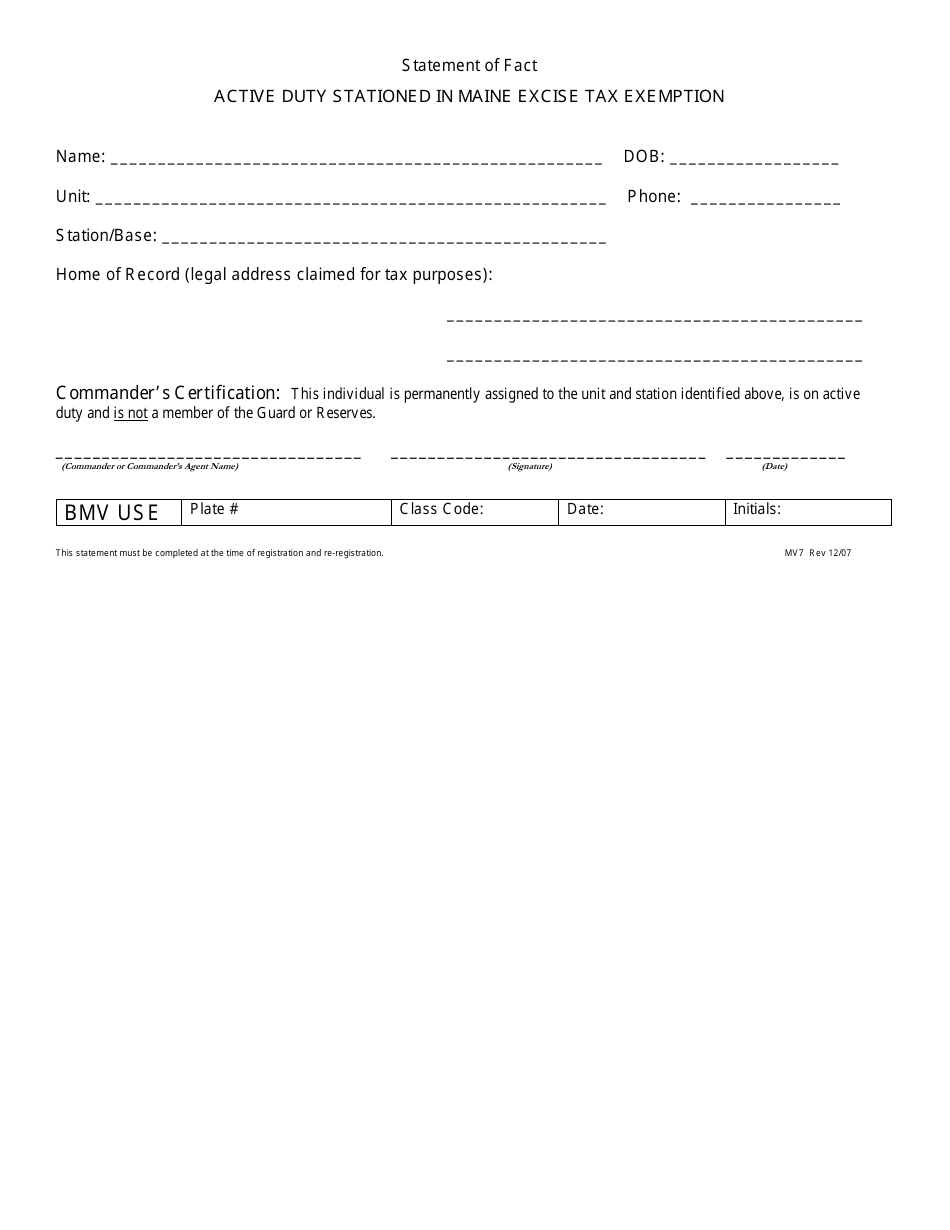

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Veterans Excise Tax Exemption Ordinance. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that registration year for any one vehicle toward the tax for any number of vehicles regardless of. Board of Appeals Ordinance.

207-626-4471 Homeless Veteran Coordination Team 207-287-7019 Maine Veterans Memorial Cemetery System 207-287-3481. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to. 434 20 is further amended to read.

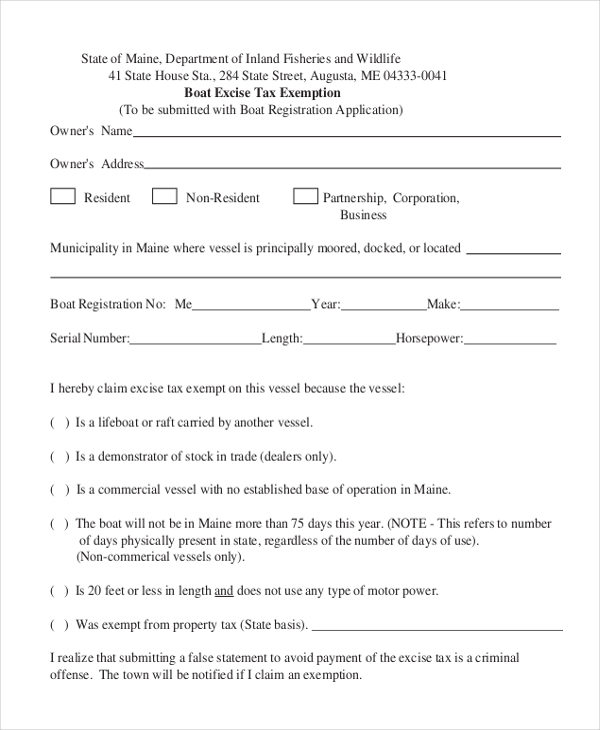

Except for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject to the Excise Tax. The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. Animal waste facility 36 MRS.

Vehicles owned by this State or by political subdivisions of the State. Maine Bureau of Veterans Services Central Office 117 State House Station Augusta ME 04333-0117. Be it enacted by the People of the State of Maine as follows.

Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on. The following exemptions qualify for reimbursement. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Shoreland Zoning supplemental application. To qualify for this exemption the resident must present to the municipal excise tax collector certification from the commander of the residents post station or base or from the commanders designated agent that the resident is. The Maine Legislature passed a bill that gives 100-disabled veterans exemption from excise tax on one registered vehicle.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. Excise tax imposed pursuant to 36 MRSA. 36 MRSA 1483 sub-12 as amended by PL 2009 c.

March 9 2022 News. The following are exempt from the excise tax. Those sections of this Act that amend the Maine Revised Statutes Title 36 section 653 subsection 1 paragraphs C and D and enact Title 36 section 653 subsection 1 paragraph C-2 apply to property tax years beginning on or after April 1 2009.

Excise Tax is an annual tax that must be paid prior to registering your vehicle. The excise tax due will be 61080. The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation.

Excise Tax is defined by State Statute as a tax levied annually for the. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for. Where do I pay the excise tax.

692021 - PASSED TO BE ENACTED. Home of Record legal address claimed for tax purposes. 6551T Veterans exemption 36.

AIRCRAFT HOUSE TRAILERS AND MOTOR VEHICLES. Sponsored by Representative Heidi Brooks. What is Excise Tax Excise Tax is an annual tax that must be paid when you are registering a vehicle.

Adult Use Marijuana Licensing Ordinance. 691 - 700-B Homestead 36 MRS. Comprehensive Plan Revised 2005.

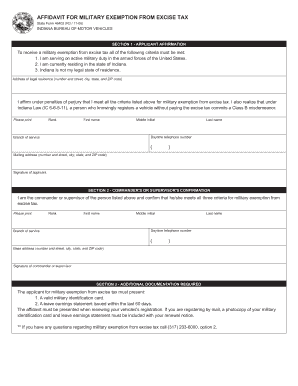

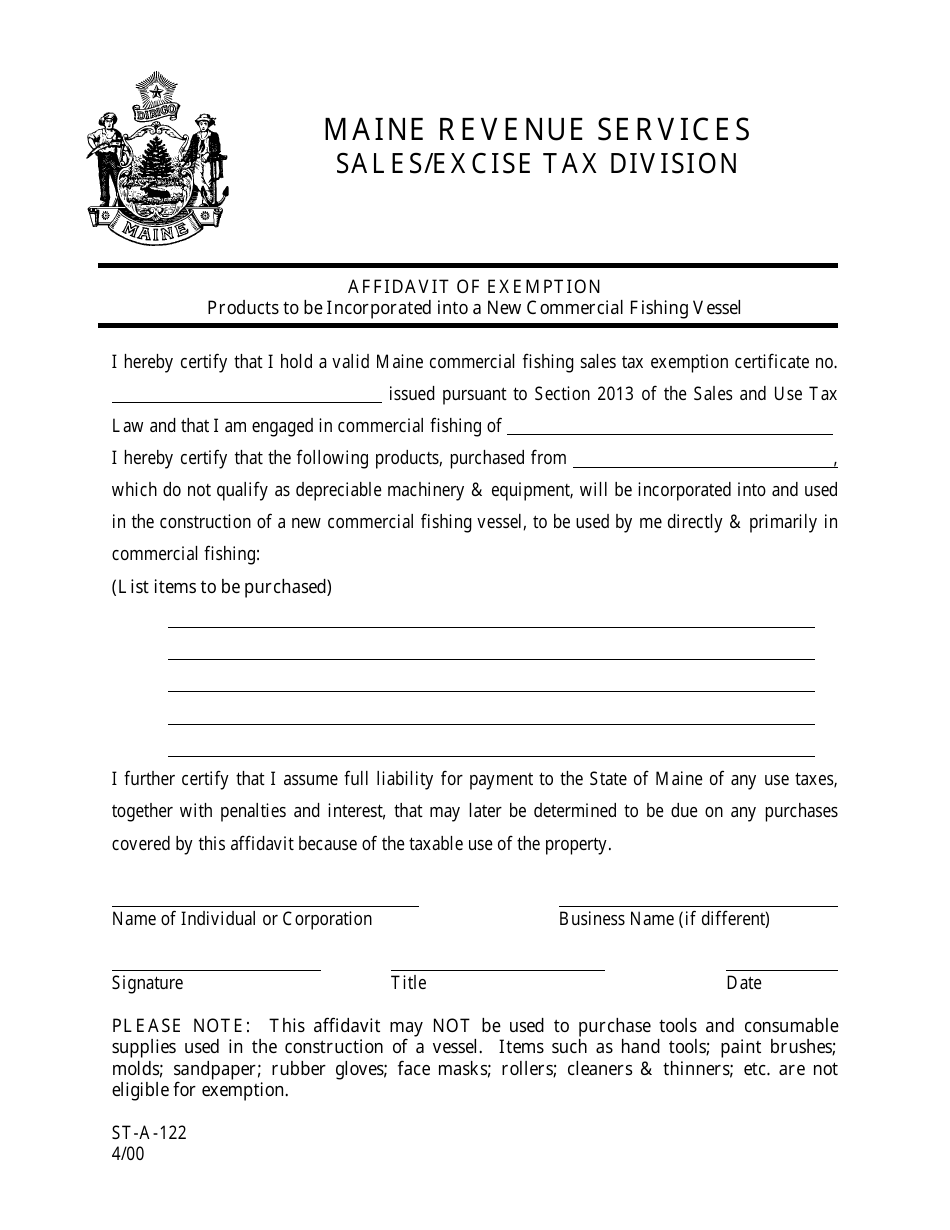

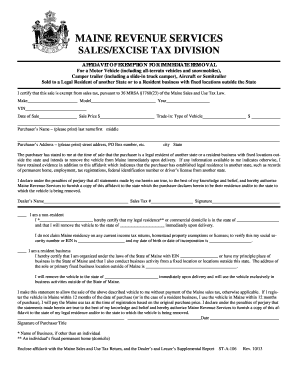

LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION AFFIDAVIT OF EXEMPTION For purchases of electricity fuel or depreciable machinery or equipment for use in commercial agricultural production commercial fishing commercial aquacultural production or.

Motor Vehicle Excise Tax Finance Department

Form Mv7 Download Fillable Pdf Or Fill Online Active Duty Stationed In Maine Excise Tax Exemption Maine Templateroller

Property Tax Stabilization Program For Seniors Cumberland Me

Exemptions From The Maine Sales Tax

Now Accepting Online Tax Payments Finance Department

How Do State And Local Property Taxes Work Tax Policy Center

Form St P 70 Fillable Industrial Users Exemption Certificate

How Do Marijuana Taxes Work Tax Policy Center

Free Maine Boat Bill Of Sale Form Pdf Word Rtf

Form St A 122 Download Printable Pdf Or Fill Online Affidavit Of Exemption Products To Be Incorporated Into A New Commercial Fishing Vessel Maine Templateroller

Maine Estate Tax Everything You Need To Know Smartasset

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Welcome To The City Of Bangor Maine Excise Tax Calculator

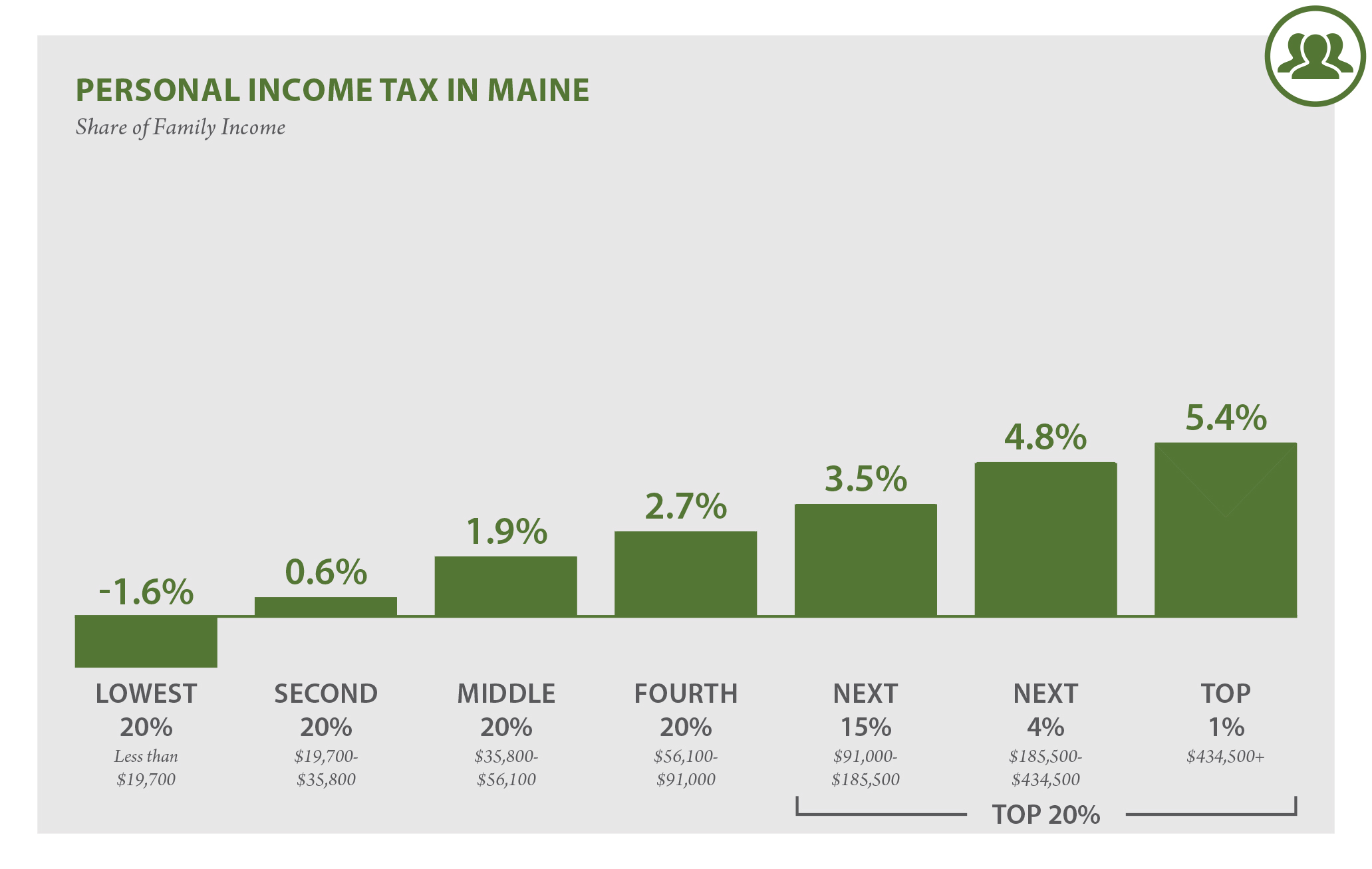

Maine Who Pays 6th Edition Itep

Maine Sales Tax On Cars Everything You Need To Know

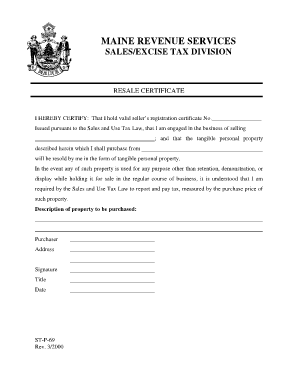

Maine Resale Form Fill Online Printable Fillable Blank Pdffiller

22 Printable Express Truck Tax Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Maine Income Tax Calculator Smartasset

100 Disabled Veterans Are Exempt From One Vehicle Excise Tax Title Fee And Drivers License Renewal Fee Town Of Paris